income tax submission 2019

Bank of India has been migrated from OLTAS e-Payment of Taxes at. म 42019 म सव नवतत ह गय मन.

Income Tax Return 2019 Last Date Tax Return Income Tax Return Income Tax

Those who are interested to serve in North Eastern Region NER can apply through offline mode on or before 16 September 2022.

. As in Hypothetical 6 under the US-Country T tax treaty Country T would have the primary right to tax Janes wage income and the United States would have a secondary right to tax the income based on her citizenship after providing a credit for the income tax paid to Country T. Advance income tax rulings and technical interpretations. Update Notice Preferences Individuals.

Section 245 of the Income Tax Act October 21 1988 and IC 88-2S1 General Anti-Avoidance Rule July 13 1990. Until such an asset is converted to money and upon submission of a declaration by the NRI to apply the. Due date for claiming foreign tax credit upload statement of foreign income offered for tax for the previous year 2021-22 and of foreign tax deducted or paid on such income in Form no.

Easily calculate your taxes online for Assessment Year 2023 - 24 FY 2022 - 23 FY 2021 - 22 FY 2020 - 21 with Goodreturns Income Tax Calculator. Late submission penalty models. On June 10 2016 the Treasury Department and Internal Revenue Service the Department of Health and Human Services and the Department of Labor the Departments issued proposed regulations PDF that implement the Expatriate Health Coverage Clarification Act of 2014 EHCCA.

Generally if you have adjusted gross income for 2019 up to 75000 for individuals and up to 150000 for married couples filing joint returns and surviving spouses you will receive the full amount of the second payment. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. If they file a 1040NR to report US-sourced income they would not include their foreign interest income.

One day Special online Course on Faceless module. The EHCCA generally provides that most ACA provisions do not apply to expatriate. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

In online mode either XML needs to be uploaded or client can directly login to income tax portal and select the submission mode as prepare and submit online. E-Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries. Law and Procedure of reassessment us 147 b.

You can still claim the equivalent Recovery Rebate Credit when you file your 2020 federal income tax return. The Exchequer 85 billion in 2018 to 2019. Information Circular IC 88-2 General Anti-Avoidance Rule.

Montanas maximum marginal income tax rate is the 1st highest in the United States ranking directly below Montanas. Now it is very easy to. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Self Assessment is a system HM Revenue and Customs HMRC uses to collect Income TaxTax is usually deducted automatically from wages pensions and savings. Submitted your 2019 to 2020 tax return on or before 2 March 2021. 34 April 27 2006 and Issue No.

Income Tax Slab for Financial Year 2019-20. Trading profits of no more than 50000. Benefits of Filing Income Tax Return on time AY 2019-20.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Income tax rate for 2014-2019 is 25. Royalty income is sourced where the royalty is.

22 January 11 2002. If due date of submission of return of income is October 31 2022. 10000 will need to follow the rules for Making Tax Digital for Income Tax from 6 April 2024.

The above calculator provides for interest calculation as per Income-tax Act. The best time to obtain supervisory approval for the section 6702 penalty is after the expiration of the 30-day period. Retrieval of information from various portals to be held on 10062022 - Nominations - reg.

Unlike the Federal Income Tax Montanas state income tax does not provide couples filing jointly with expanded income tax brackets. The notice is for the Income Tax Inspector and Tax Assistant Posts. It is calculated based on the tax slabs defined by Income Tax Department.

Government released New ITR filing portal on 7th June 2021 for improving efficiency of IT Portal best user interface and better user services. BIPS Service Giving Declaration Form Submission. People and businesses with other income.

Individuals whose income is less than Rs25 lakh per annum are exempted from tax. For FY 2019-20 if individuals have come to India on a visit before 22nd March 2020 and they are. 10-IJ and Form No10-IL are available for filing on the portal.

Americas 1 tax preparation provider. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Montana collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for payment from 20-03-2020 to 29-06-2020 shall attract interest at the lower rate of 075 for every month or part thereof if same is paid after the due date but on or before 30-06-2020. However since the day of its launch portal is facing many problemserrors like unable to File ITR on New Portal unable to do EVC E-verify of ITR non launching of schema of. In the case of online filing some data can be imported from the latest ITR or form 26AS.

Income tax is a type of direct tax the central government charges on the income earned during a financial year by the individuals and businesses. The income tax slab is a slab under which an individual fall is determined based on the income earned by an individual. The grant is subject to Income Tax and self-employed National Insurance.

Your company is taxed at a flat rate of 17 of its chargeable income. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

A Nonresident Alien who resides outside of the United States is not a US person so is not subject to tax on worldwide income. The Tax Court has ruled that the IRS supervisory approval for the section 6702 penalty does not need to be obtained before issuing Letter 3176C Kestin v. Read the guide on implications of Income Tax for NRI to know your tax laibility and how to file your income return in India online.

Income Tax Module - Course on Merger and Acquisitions and Mergers to be held on 08052022 - Nominations - reg. The tax exemption scheme for new start-up companies and partial tax exemption scheme for companies are tax reliefs available to reduce companies tax bills. 1 online tax filing solution for self-employed.

30th September 2022 Submission of audit report. To avoid any issues during submission. Income Tax Technical News Issue No.

The income tax return verification will be displayed on the screen on the successful submission.

Freetaxusa Free Tax Filing Online Return Preparation E File Income Taxes

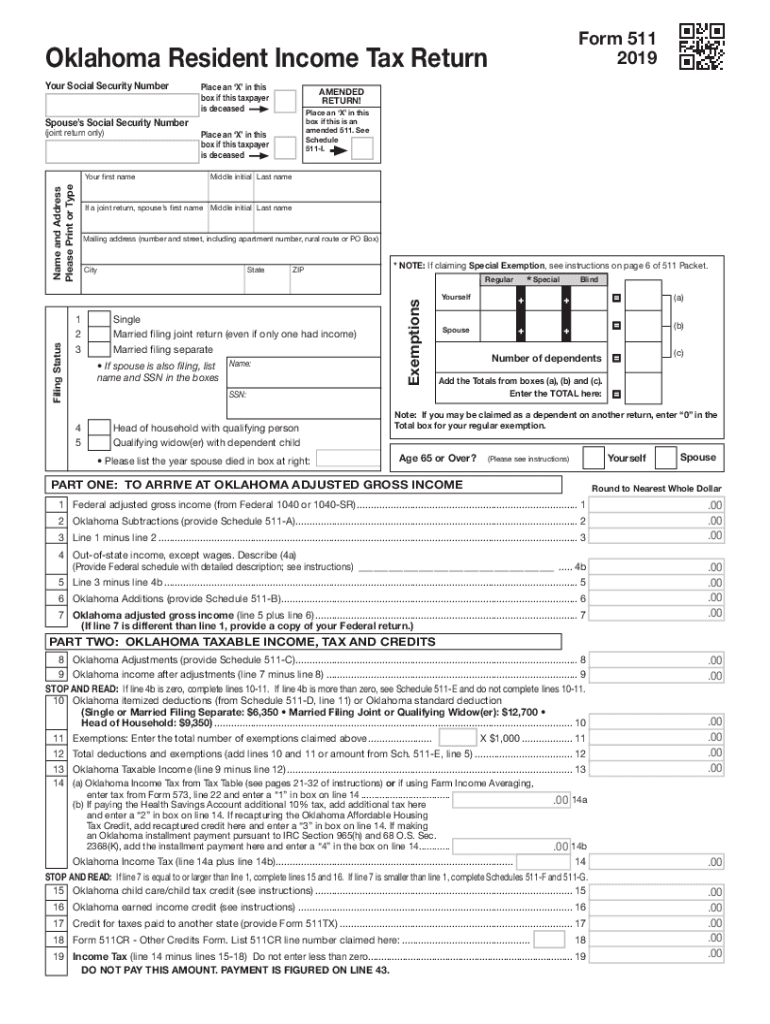

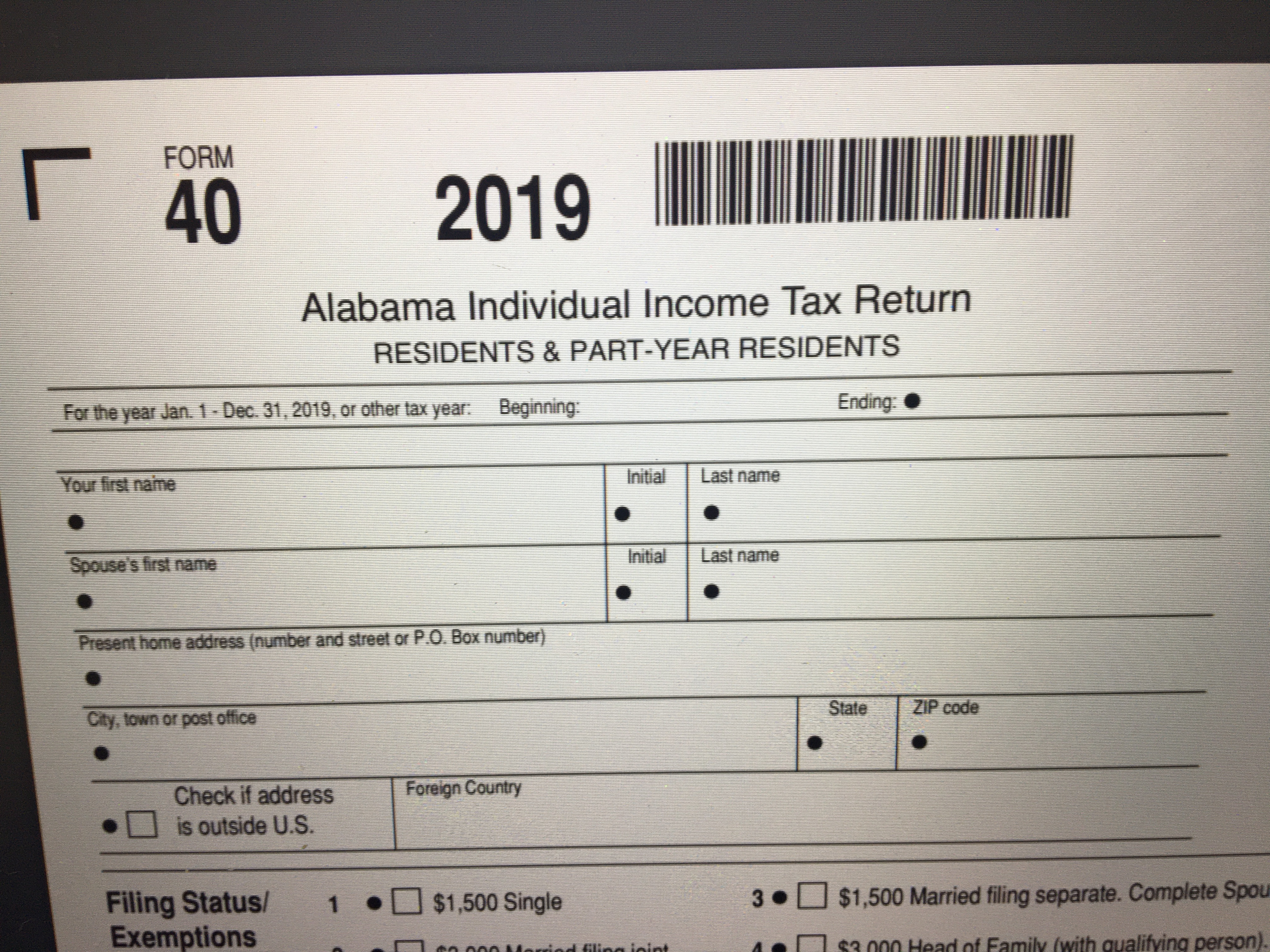

Oklahoma Resident Income Tax Return 2019 Fill Out Sign Online Dochub

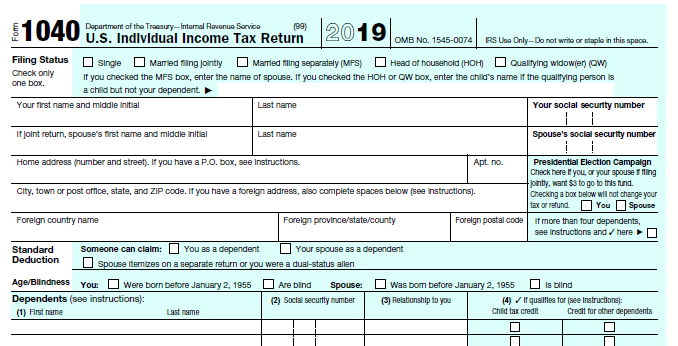

Irs Tax Form 1040 U S Individual Income Tax Return

Irs Head 6 Million Tax Returns Are In Suspension Thousands Of 2019 Returns Still To Be Processed Wpxi

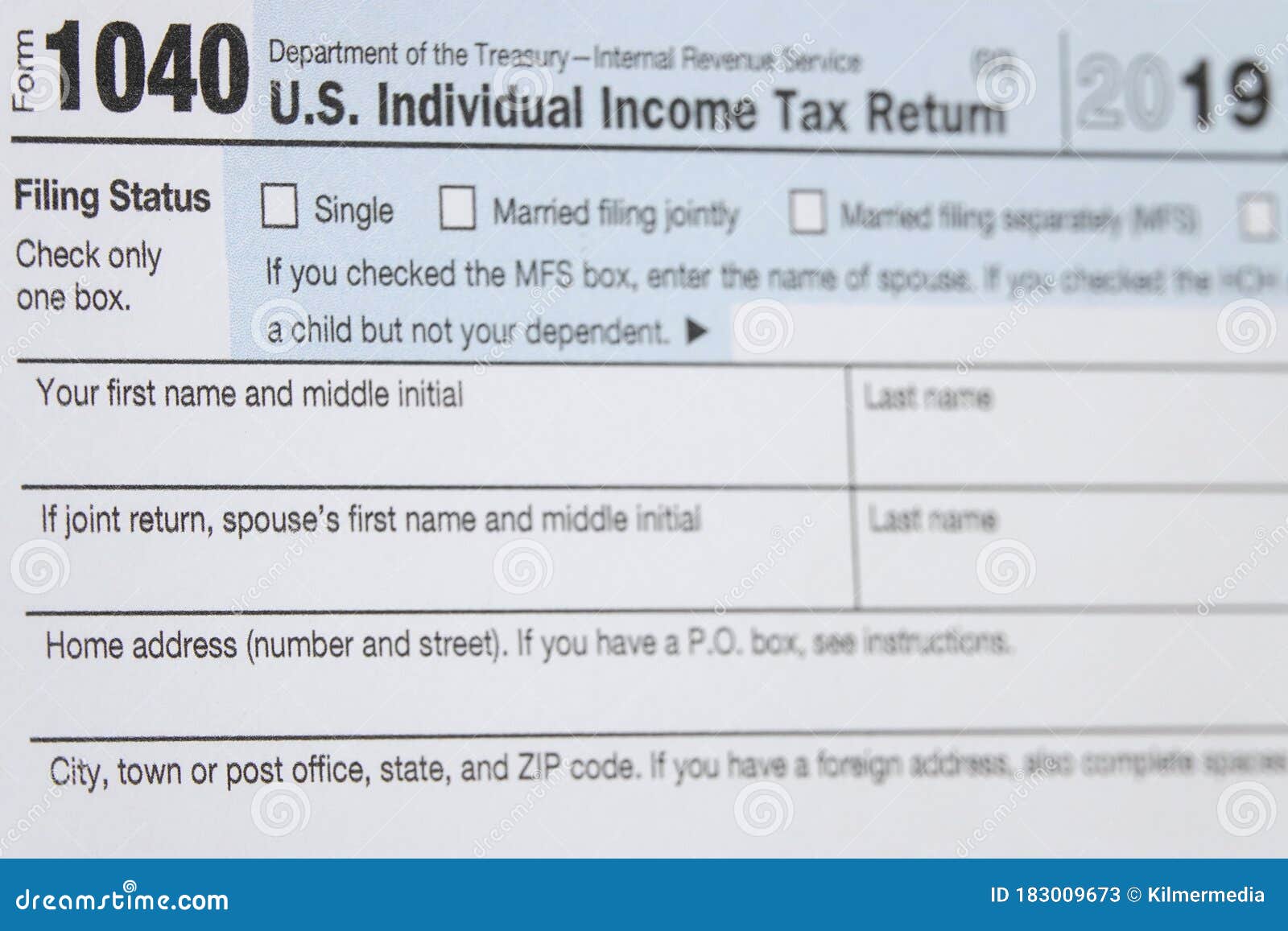

Printable 2019 Irs Form 1040 Us Individual Income Tax Return

Fillable Online U S Individual Income Tax Return 2019 Omb No 1545 0074 Fax Email Print Pdffiller

Usa Irs Income Tax Return Form 1040 In 2020 For 2019 Filing Macro Editorial Stock Photo Image Of Form Government 183009673

When Does Tax Season Start This Is The Earliest Date For Filing 2019 Tax Returns Syracuse Com

Irs Begins Accepting Tax Returns Jan 27 Nbc 5 Dallas Fort Worth

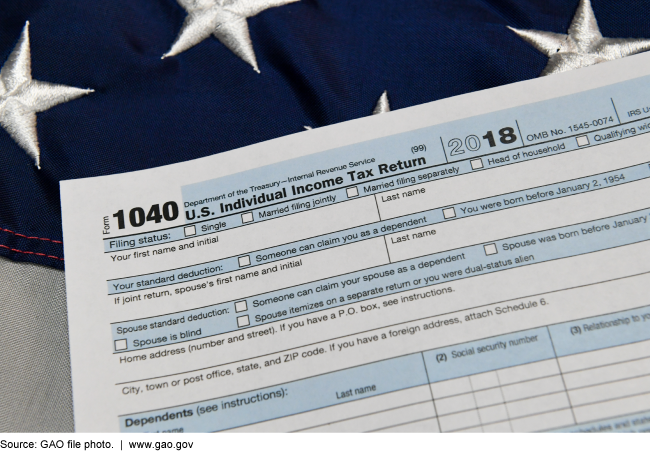

2019 Tax Filing Irs Successfully Implemented Tax Law Changes But Needs To Improve Service For Taxpayers With Limited English Proficiency U S Gao

Irs Releases Drafts Of Forms To Be Used To Calculate 199a Deduction On 2019 Income Tax Returns Current Federal Tax Developments

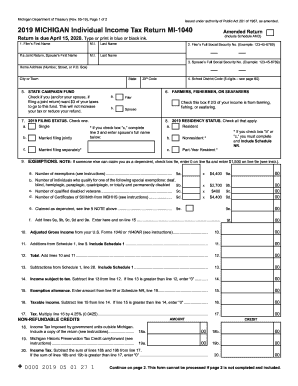

Michigan State Income Tax Form 1040 Fill Out And Sign Printable Pdf Template Signnow

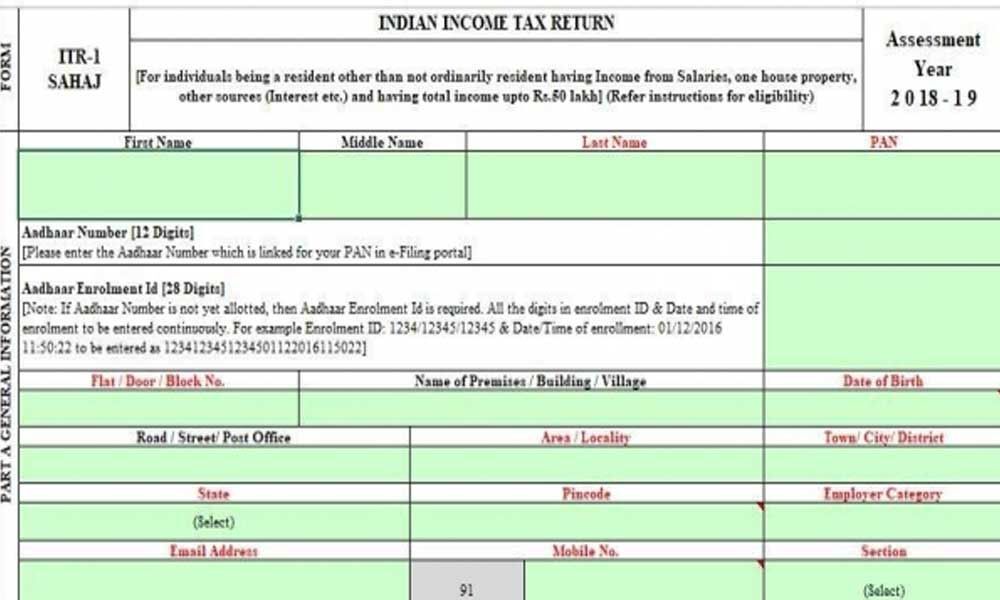

Income Tax Returns Forms For 2019 20 Released Here S All You Need To Know

Key Changes To Keep In Mind While Filing Your 2019 Taxes Kabb

Gov Kay Ivey Delays State Income Tax Deadline To July 15 Al Com

Taxes 2019 Here S How Details Affect Your Refund What You Owe

Last Call For Filing 2019 And 2020 Tax Returns

Verify Deadline To File 2019 Taxes Changes Wusa9 Com

Fillable Form 1040 2019 Income Tax Tax Return Income Tax Return

0 Response to "income tax submission 2019"

Post a Comment